Reviewed by Prabhakar Shetty, practising advocate at the Karnataka High Court

Buying property in Bengaluru can be confusing and risky – there are multiple authorities for land use approvals, obscure rules, and the finer details are often missed out. In this article, we explain what buyers and investors should know about different land types and the authorities regulating each.

Following are some basic questions you need to ask before buying property.

Which authority does your property fall under?

Bengaluru’s Local Planning Area is divided among the BBMP, BDA (Bangalore Development Authority), and the BMRDA (Bangalore Metropolitan Region Development Authority).

- The constantly-expanding inner core of the city falls under the BBMP.

- BDA acquires land notified by the Urban Development Department, and even forms Layouts where required. Once BDA completes development, the area is handed over to BBMP for tax collection and maintenance.

- Outer areas, that don’t come under the jurisdiction of either BBMP or BDA, come under the purview of BMRDA.

Who sanctions building/layout plans?

BBMP sanctions the plans of apartments, individual houses and commercial buildings. For any layout, irrespective of whether the land is under the jurisidction of BBMP or BDA, the plan-sanctioning authority is BDA.

In areas under the BMRDA, its five Local Planning Authorities (LPAs, designated as per their locations at Nelamangala, Kanakapura, Magadi, Anekal and Hoskote), along with the Ramanagara–Channapatna Urban Development Authority (RCUDA), Bangalore International Airport Area Planning Authority (BIAAPA) and Bangalore Mysore Infrastructure Corridor Area Planning Authority (BMICAPA), are the plan-sanctioning authorities. You need to get plan sanction from the one that has jurisdiction over your land.

- BIAAPA: This is a plan-sanctioning authority for land use only around the airport. It deals with the ‘island’ containing the airport as well as parts of Bengaluru North, Devanahalli and Doddaballapur. In sanctioning any land development plan, its primary focus is on the airport’s operation and the flight paths of aircrafts.

- BMICAPA: Like BIAAPA, BMICAPA is the plan-sanctioning authority exclusively for areas along the Bangalore-Mysore Infrastructure Corridor. In Bengaluru, this corridor includes parts of Kengeri, Uttarahalli and Yeshwanthpur.

Layout/apartment plans that are sanctioned by the panchayat are not valid for properties developed in the jurisdiction of BBMP, BDA or BMRDA. These plans are valid only if the land in question lies beyond BMRDA limits; such properties come under the state government’s Directorate of Town and Country Planning (DTCP).

Is the land classified as ‘for residential use’?

When you are considering buying a home or a flat, always check that the land it is standing on has been classified as ‘for residential use’. This simple check can save a lot of hassle later.

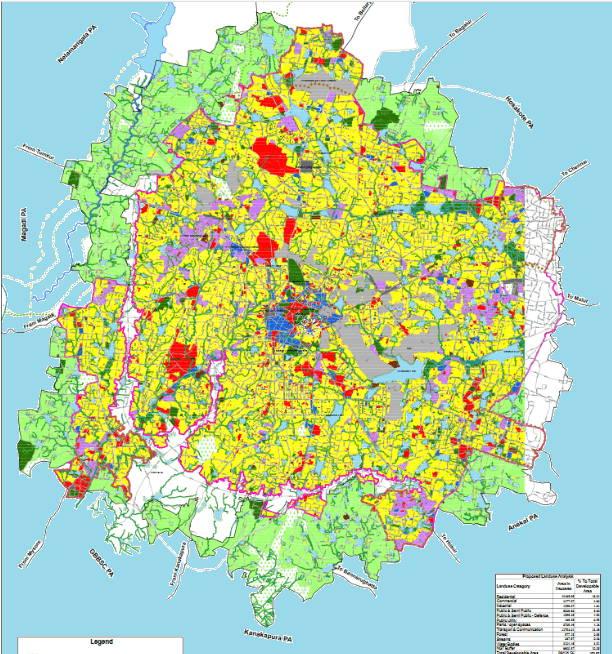

The purpose for each which each parcel of land can be used – residential, commercial, etc – is specified in the Zoning and Land Use Rules. These rules are laid out in BDA’s Master Plans for the entire Bangalore Urban district. The Revised Master Plan (RMP), 2015, is in force currently, and will be till 2031. For properties in BMRDA limits, there’s a separate Master Plan that details land use and zoning rules. The rules are similar in both the Master Plans.

The main classifications of land use are:

- Residential (R)

- Commercial (C)

- Industrial (I)

- Public & Semi-public (P&SP)

- Parks & Open Spaces (P)

- Traffic and Transportation (T&T)

- Public Utilities (PU)

- Unclassified (UC)

- Agriculture Land (AG)

A residential property is legally compliant only if it’s built in a residential or mixed residential zone. But residential multi-storied apartments are allowed in commercial zones since these are treated as commercial activity in the hands of the developer.

If the property you are planning to buy is part of a project that already has a sanctioned plan from the BDA or the BMRDA, or a sanctioned building plan from the BBMP, the plan is presumed to be compliant with the land-use rules.

What is a Revenue site?

Revenue site is a site that has agricultural roots and has not been converted into residential/commercial property. The term became popular as the owners of such properties used to pay agricultural revenue tax earlier.

The title for agricultural land is extinguished if BDA acquires the land and forms a layout. Pockets of land within BDA/BBMP/BMRDA jurisdiction that are not acquired and not converted remain as agricultural land.

If these properties are turned into sites without conversion, they are called revenue sites. Properties in such unconverted land may show an architecturally-correct layout plan, but the plan may not carry the seal of any of the sanctioning authorities except perhaps the panchayat.

Based on the seal of the panchayat, owners of such sites will get a House List number and Khata number issued by the old village panchayat office, but only if the site is within prescribed distance of the panchayat office. (Sites without conversion and also beyond the prescribed distance from the panchayat office, are illegal even if the panchayat collects house tax and assigns a Khata number to it. Non-agricultural activities in such sites can be removed, and the government can even confiscate the land.)

Revenue sites have problems of resale, bank loan availability and marketability. The sub-registrar will sometimes freeze the registration of such sites, and sometimes the government will allow registration. As per revenue rules of Karnataka, revenue land without conversion can be measured only in guntas; and only an agriculturist can buy land in guntas. Banks usually will not provide loans for such sites, but some risk-taking banks may provide a composite loan to build a house.

Application for conversion of revenue sites needs to be given by the original land owner. From agricultural use, the land can be converted to residential or commercial use.

How to convert agricultural land?

Conversion from original land use to desired land use is done by the Deputy Commissioner for Bangalore Urban district, and such conversion is governed by the relevant Master Plan. Before conversion, the prospective owner/buyer needs to check the purpose for which the land can be used as per the Master Plan.

The owner of agricultural land can choose not to convert it and continue to use it as agricultural land. But if they opt for conversion at all, it has to be according to the land use prescribed for that zone.

If you see notices such as ‘sites for sale’, or ‘homes/apartments for sale’, first check what land use is permitted at the site according to the Master Plan. Then ask for the conversion certificate, and check for the plan sanction if the site or home or apartment is in a layout. Finally, check for clear titles to the property.

What is Gramathana property?

Gramathana represents the original place of residence within a village. Gramathana properties do not need conversion to residential use as they have been used as residences for a long time. In village maps which go back to British days, these Gramathanas can be observed as having been marked as ‘ooru’ (village) properties surrounded by survey numbers corresponding to agricultural lands. Even in BBMP areas, there are Gramathanas for which you can directly obtain a Khata, provided the land is a genuine Gramathana.

Forms 9 and 10, which were tax-paid receipts issued by village accountants or other revenue officials in the early days, were previously used as proof of a property being designated a Gramathana property. But in the 1990s, these forms were issued to lands with survey numbers (agricultural lands) too, and some sellers used these forms to pass off unconverted agricultural land as Gramathanas and convinced customers to buy these.

However, even now there are genuine Gramathana properties within the city. To ensure genuineness, obtain a certificate from the Department Of Survey, Settlement & Land Records (central office at K R Circle), stating the property is a Gramathana.

[This article was originally published in the book ‘Buying, Renting and Investing in Property in Bengaluru’, and has been reviewed and updated by Advocate Prabhakar Shetty. In part 2 of this series we explain what documents you need, to buy property in Bengaluru.]

Thanks for this article, it clears a lot of doubts

Bought residential land 16 years back from a developer. The old landowner who the developer has bought from is harrasing us for the property. What should be done. Have paid the upto date property taxes. Have a PID number, EC etc but still they demand the property.

Very detailed article and insightful even for people who have been in B’lore for long. Thank you!

Please write an article about LTCG On property On income tax why assessing officer insisting construction agreements to register under karnataka stamp act where there was no provision to do registration of construction agreement prior to RERA period 2018..unnecessarily cases are pending for issuing NOC for closure of LTCG deposits in NATONAliSED bank and either bank agreed to close the LTCG deposit account nor incometax authorities issue NOC inspite of the fact the sale transaction were declared and tax paid on earning of LTCG earning in the 2015. Unnecessarily the money blocked in LTCG deposit in nationalesed bank since last 5 -6 years

Thank you for your clarifications… Recently govt declared that revenue sites within BDA layout will be regularised by collecting some penalty. Please let me know where this can be done and how to go about it… please mail me the details…

Thank you for such a wonderful detailed information on the properties. Very useful information.

I am glad you have come with this article. Thanks. Can you please also list out reliable plots/ Villas by builders.

How about the revenue land,which I bought 10years back, near Stonehill international school,tarahunise village,can I sale it,though I have B khata and paying regular taxes.

Kindly suggest.

These sites can be regularised under the AKrama Sakrama scheme. You have to wait for the govt to enforce the scheme. Selling option is rare as revenue land buyers are very less. However you can sell it by posting in on portals like MagicBricks, 99 acres, NoBroker etc

Please check out for the joint development agreement between the land owner and the developer. As per the agreement if all the terms and conditions are fulfilled by the developer to the land owner, there the land owner does not have any entitlement on the land. In case there are any pending issues, you may have to contact the developer to get things cleared. In case you are not able to find the developer(since it is already 16 years old), find out whether there any pending litigation on the property by the land owners family. Then you may have to amicably settle things with them.

Yes you can sell it, provided it does not fall under the green belt area. But you have to approach the panchayat office and get clarification on the land for selling. Thank he revenue sites are hard to sell as there are not may people to buy it. Else you may have to wait till akrama sakrama is initiated and get it regularised by paying penalty charges.

Thank you so much for such a wonderful detailed information on the properties. It’s clears a lot’s of my doubts, Very useful information.

Purchased a property in Kaggdaspura 25 years back,HAL sanitory board issued khatha,before constructing should be obtain A khatha.

Sir,In Bangalore what is B khata site,khata no given under BBMP wards.Some paid Betterment charges had A khata.Plan sanctions are given for khata sites,but B khata sites not sanctions plan for example kn BBMP ward no 26.Dven though HDFC bank sanctions housing loan also if we convert khata from B Khata to A khata.what is the procedure.

No need to worry in possessing B Khatha. Khata is issued for tax paying purposes. If you possess sale deed that establishes your ownership to the property.

It is the responsibility of the Revenue officer to issue Khatha to collect taxes.

Yes you can sell it if you possess sale deed. Khata part has nothing to do with registration of sites.

How can I find out about the Property Tax amounts to be paid for 2020-2021, for rural areas along the BMICAPA corridor, such as Bidadi, Eagleon, Magnolia Gardens etc.

How do I find out what are the suggestion registration value for my house in the BMICAPA corridor in Magnolia Gardens, Bidadi 562109.

Sir,

We have bought a land converted for residentiaL purpose in and kaladda. Bmrda approval of the site layout development is available. 60% of sites are released as per the clearance given by anekal,,, authorities. Developer has not completed development, so balance 40% sites are not released. We are paying tax to the piece of land purchased. Can we build house or can we sell it off or what happens.

I am constructing house on a revenue layout formed in 1997 with 500 sites in bangalore rural,

Today tahsildar issued notice to layout association saying it’s illegal layout, already there are 40+ houses,

What should we do now.

Hi, I paid to marketing person for Gram Panchayath site in Hulimangala Bangalore, Suddenly manual khata registration stopped, when will resumes don’t know. Please can any one know when will resume manual khata registration?