Think of BBMP and the first thing that pops up in your mind is roads and potholes. After an evening of rains you might think of stormwater drains, and when the garbage piles up of solid waste management (SWM). However, these are only some (of the main) parts of BBMP’s duties.

How the money is split

A look at their budget and how the money is spent on different headers gives an idea of the functions of BBMP. The main headers for budget allocations and their functions in brief are:

| Header | Description of Function |

| Council | Payment for corporators, ex-corporators, mayor, deputy mayor, etc. |

| General Administration | Payment for staff, elections, functions like Independence Day and Republic Day. Everything that cannot come under the other headers. |

| Revenue | Money from the revenue generated by BBMP paid to other bodies in lieu of cess shows up here. |

| Town Planning and Regulation | Surcharges collected for various plans for the city end up getting disbursed through this header. |

| Public Works | This is the largest header in terms of money. Roads, footpaths, flyovers, potholes, stormwater drains, lakes, streetlights, all come under this large header. |

| Solid Waste Management | Garbage collection, segregation, composting, maintenance of landfills as well waste processing units, payment for pourakarmikas all show up here. |

| Public Health General | General health in the form of maintenance of crematoria and burial grounds, animal birth control, mosquito control, etc. One of the recent additions is Indira Canteens. |

| Public Health Medical | Maintenance of Primary healthcare centers (PHCs) and hospitals, and all expenses related to them. |

| Horticulture | Maintenance of parks and playgrounds in the city, and all expenses related to them. |

| Urban Forestry | Maintenance as well plantation of avenue trees is an important function of this department. |

| Public Education | All expenses related to BBMP schools and colleges come under this header including payment to teachers. |

| Social Welfare | This includes expenses for welfare of economically weaker sections, SC/STs, trans-people, and maintenance of night shelters. It also includes financial aid given through various schemes. |

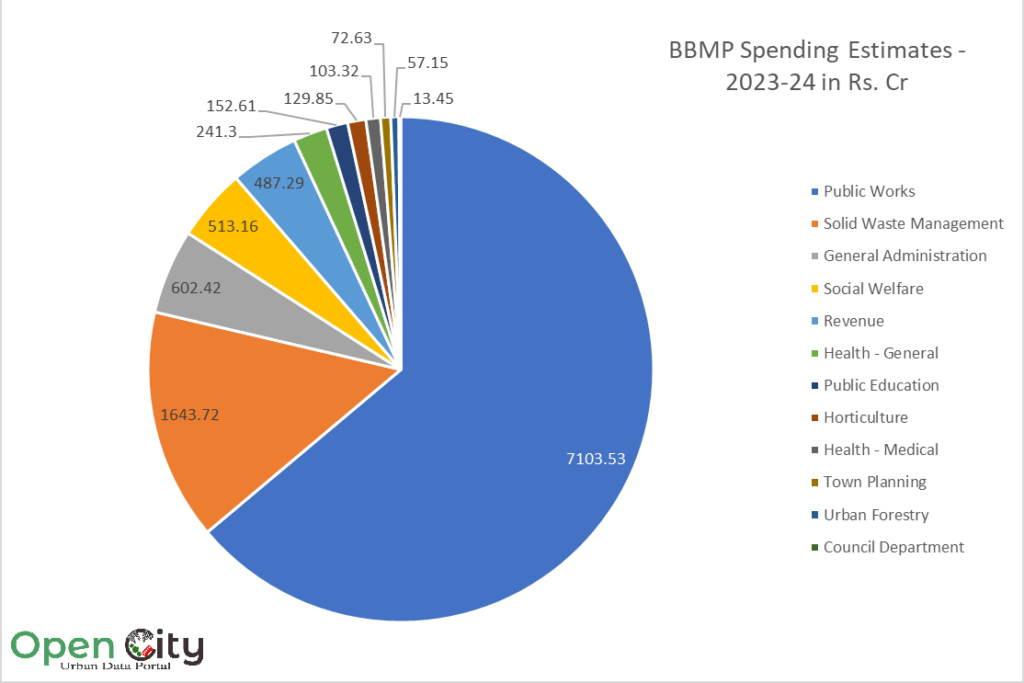

The budget allocation isn’t uniform among these headers. Looking at the estimates (allocation) in the 2023-24 BBMP budget gives us an idea of how the total funds of Rs. 11,120 Cr is split.

As you can guess, Public Works and SWM usually get the largest chunk of funds – close to 79% of the funds are split between them. The rest of the headers get much smaller amounts.

Funds utilisation among the headers

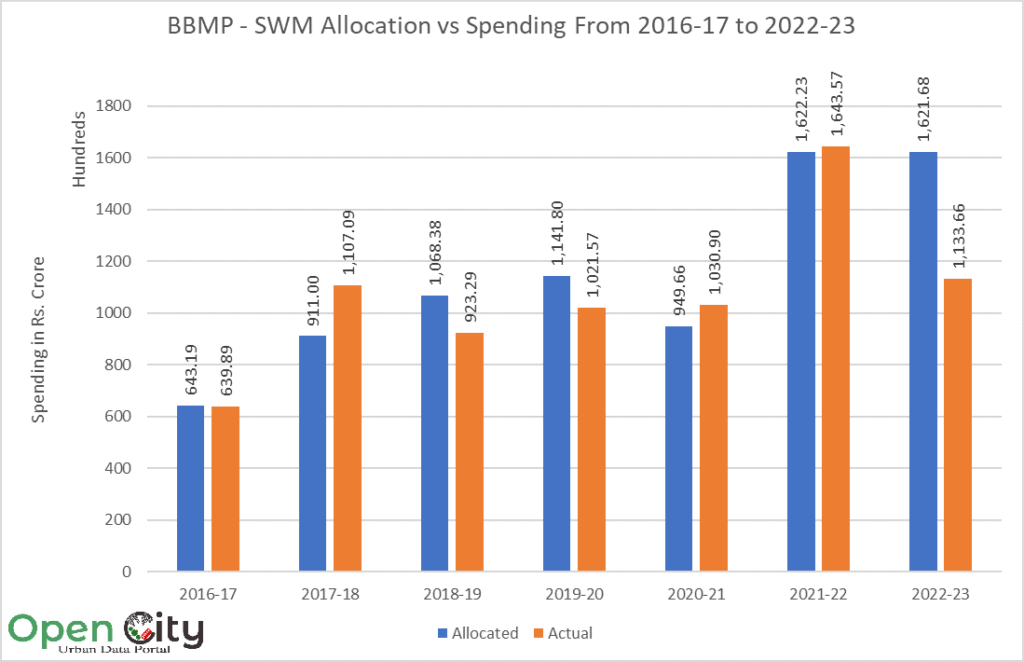

The Budget of each year not only details the allocation (under “Estimates”) for the next Financial Year, but clarifies how much of the allocation from the previous year is likely to be spent. For e.g. in the budget of the year 2023-24, for SWM, the header mentions not only the allocation of Rs. 1,643.72 Cr (“Budget Estimate 2023-24”), but also that of the allocation of Rs. 1,621.68 Cr from the budget of 2022-23(“Budget Estimate 2022-23”) they estimate the actual spending to be Rs. 1,133.66 Cr (“Revised Estimate 2022-23”), which means that they expect only 70% of the allocation of the previous year to be spent.

Read more: State budget prioritises infrastructure in Bengaluru, but governance issues remain unresolved

This revised estimate is based on their actual spending till November of that year. In the above case, the revised estimates for 2022-23 will be based on how much was spent till November 2022.

We looked at the budget estimates vs the revised estimates for each of the years from 2016-17 to 2022-23 for the important non-physical infrastructure headers like SWM, public health, public education, social welfare, horticulture and urban forestry.

Solid waste management

Solid Waste Management(SWM) is a major header for BBMP’s budget and the budget spending usually either matches or exceeds the allocation. The years where it falls short, it is not by much. The difference for 2022-23 is stark and is around Rs. 500 Cr. This is because of the establishment of the Bengaluru Solid Waste Management Limited (BSWML) by BBMP, which is expected to manage many of the functions under SWM.

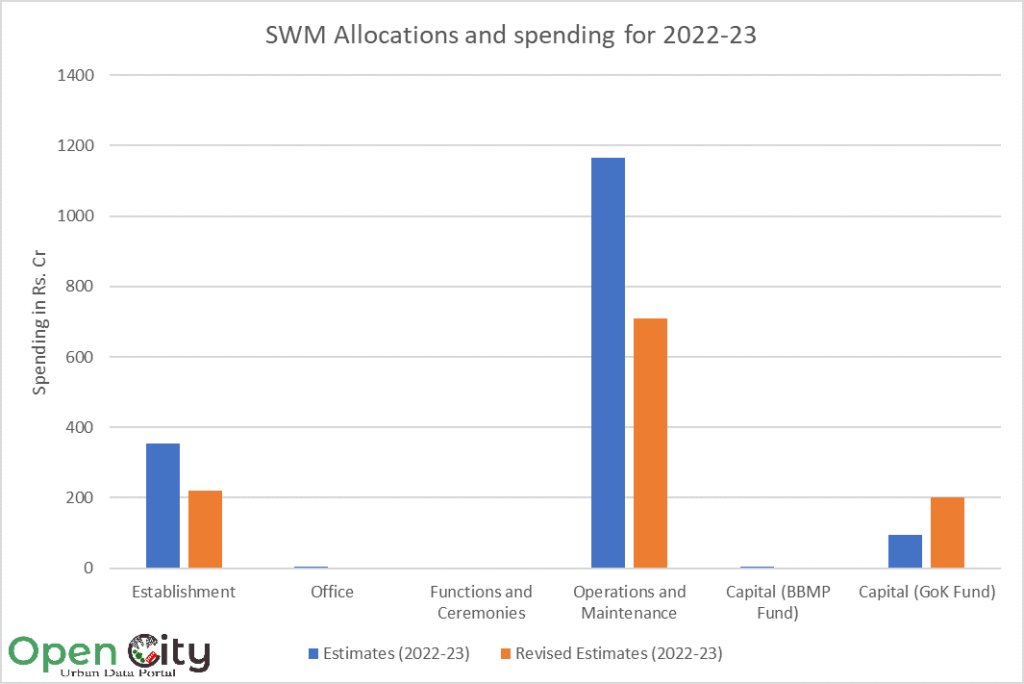

Under SWM, the various headers are Establishment (which includes salaries of pourakarmikas), Office (payment of bills etc. for their office premises), Operations and management (where the biggest chunk goes to payment of outsourced SWM expenses), Capital from BBMP and Capital from Government of Karnataka. For 2022-23 this is how the allocations under each of these headers looks like.

Public health

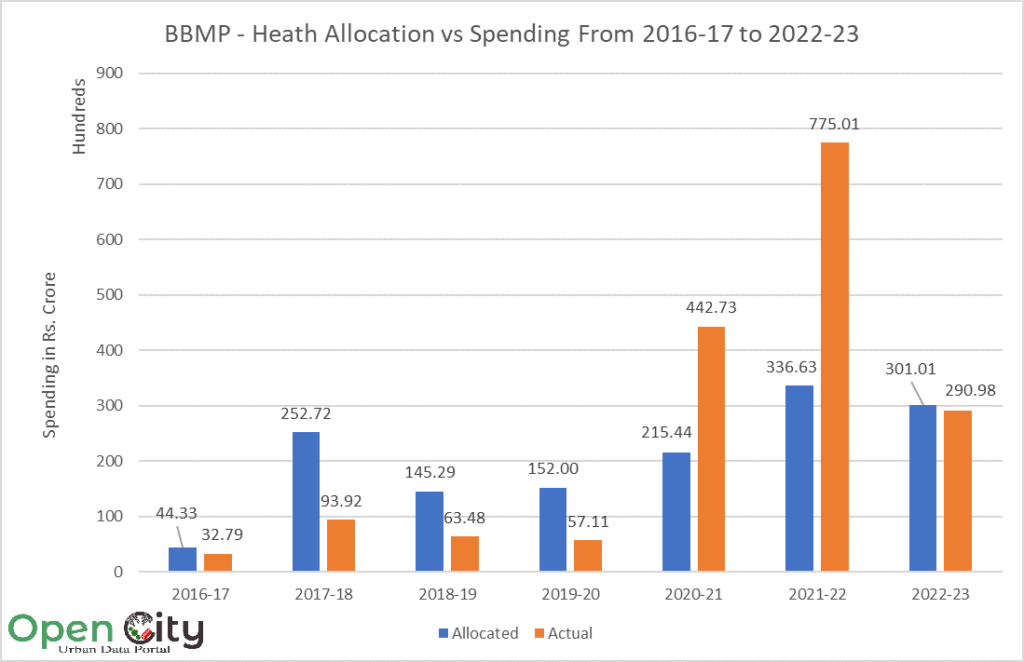

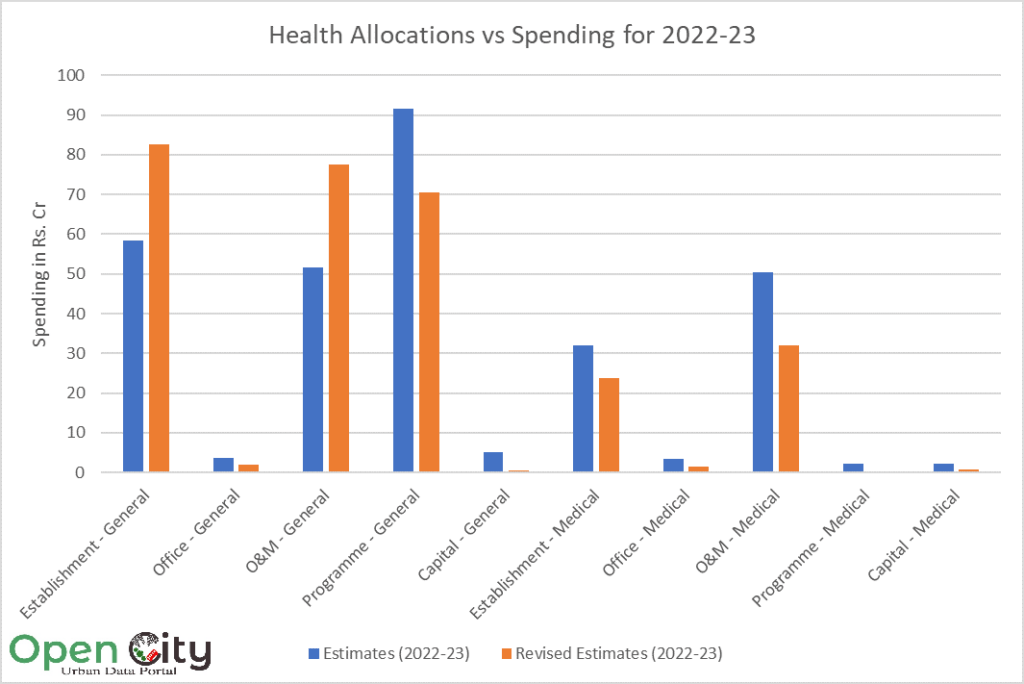

Public health includes two headers – general and medical as detailed in the table at the beginning. However, for the purpose of this analysis we combine the two headers into one as Public Health.

Public health gets only a small chunk of the allocations. In 2023-24, 3% of the budget is allocated for health. The total amount of Rs. 344.62 Crore is expected to cover PHCs, payment of doctors and nurses as well as general health in the form of Animal Birth Control, slaughterhouses, maintenance of burial grounds and crematoria, among other functions.

Read more: Budgetary allocations: Focused spending through active civic participation

Despite this, during most years the spending falls well short of the allocation. The only years where this trend was reversed were 2020-21 and 2021-22 which were the years of the pandemic, and health spending was high. This spending was accounted for under the head “Natural Calamities”.

In 2022-23, the spending is expected to be close to the allocation.

At the department level, the main difference is in General health. One of the biggest units of expenditure under General health under Programme is food supply for Indira Canteens. Rs. 37 Cr is expected to be spent on that in 2022-23. However, street dog management got only Rs. 15 Crore last year and only Rs. 10.55 Cr of that is expected to be utilised. “Natural Calamities” spending accounted for Rs. 48.55 Cr out of the allocation of Rs. 3.1 Cr under Operations and maintenance for General health.

Under health – medical, a large chunk goes to staff salary under “Establishments”. Under Operations and Maintenance, a large share is for healthcare for BBMP employees, presumably to cover their medical insurance. Rs. 15 Cr out of the same amount earmarked was spent on that.

Interesting to note is that under programmes – medical, there was Rs. 2.2 Cr allocated to provide stents to heart patients. However, not a single rupee of this was spent.

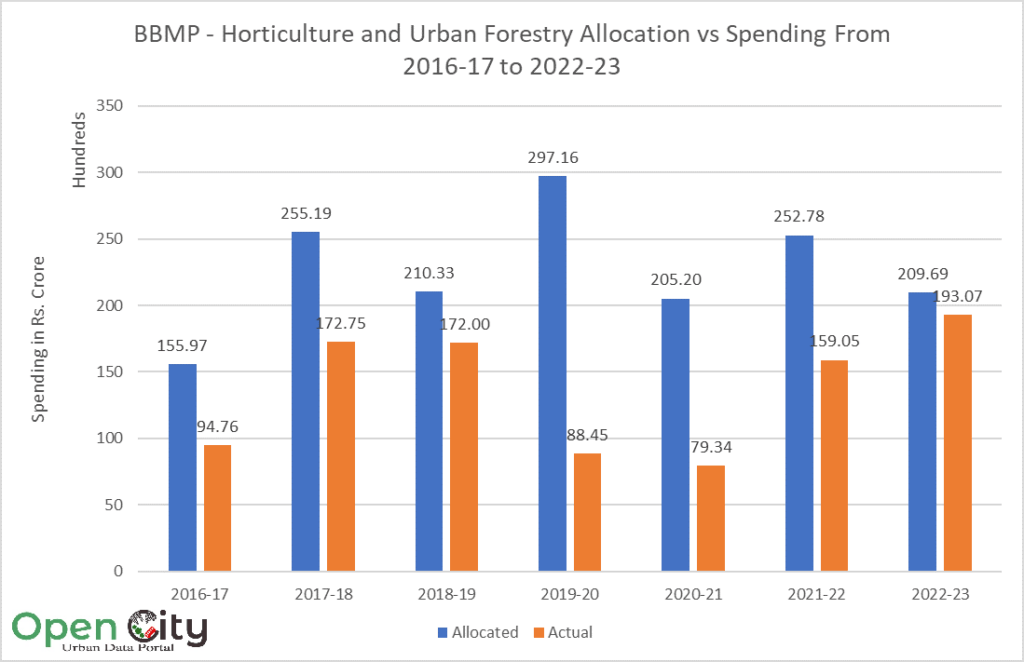

Horticulture and urban forestry

Horticulture and urban forestry includes two visible functions of BBMP – maintenance of parks and planting of trees on the road sides. Even though they are two different headers, for the purpose of this analysis they are combined into one header – Horticulture and Urban Forestry.

Like with health, horticulture and urban forestry get only a small chunk of the funds. In 2023-24, the total allocation for both was Rs. 187 Cr, 1.7% of the total budget. Despite this, the spending seen over the years is much less than what is allocated.

In horticulture, the biggest expenditure is for maintenance of parks. Rs. 127 Cr was spent in 2022-23 out of the allocated Rs. 92.3 Crore. Tree canopy management and avenue tree plantation are the corresponding largest blocks under urban forestry accounting for Rs. 8.5 Cr out of the allocation Rs. 10 Cr and Rs. 9 Cr of the same amount allocated respectively in 2022-23.

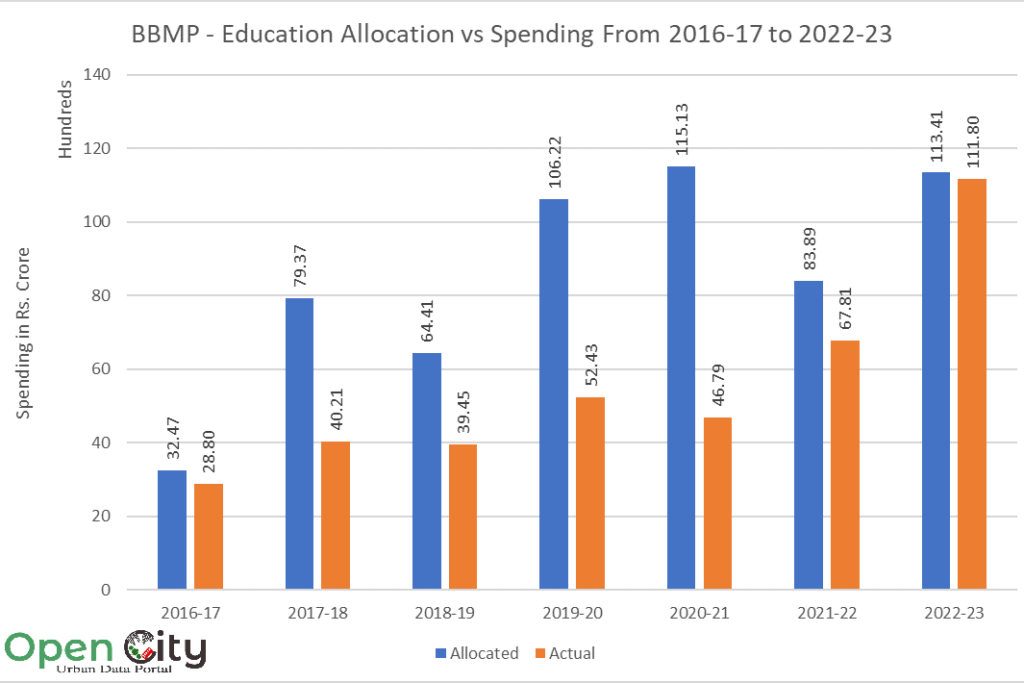

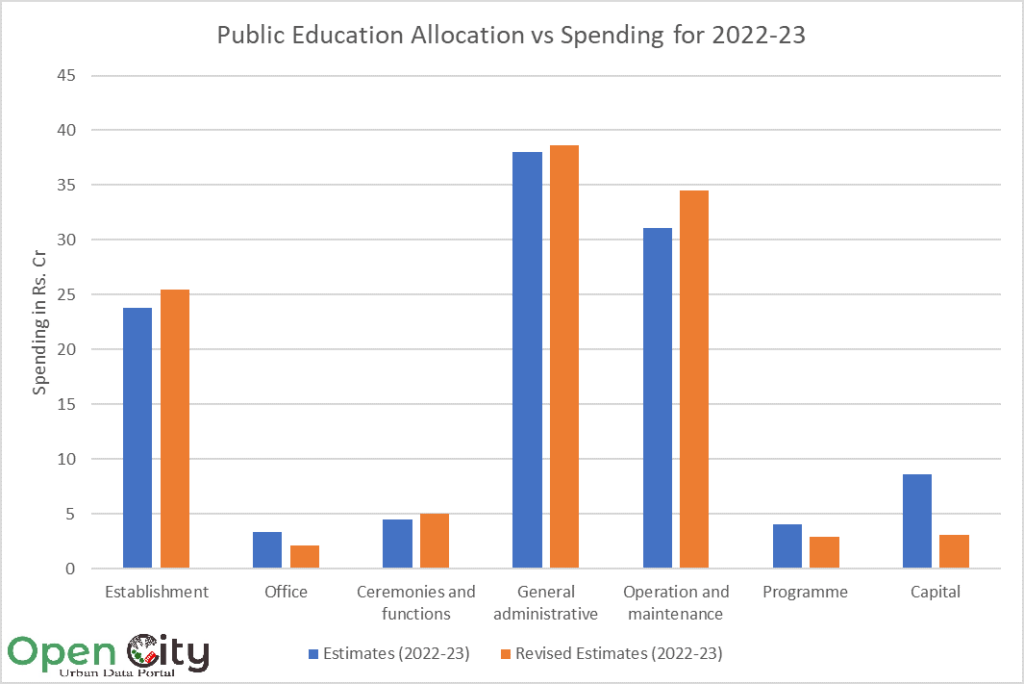

Public education

BBMP runs close to 2,000 schools in Bengaluru as well as colleges, both degree and Pre-university. However, the spending on public education is again a small part of the budget. In 2023-24 only Rs. 152.61 Cr was earmarked for education, a mere 1.4% of the total budget. This is a larger allocation than most years, where the allocation doesn’t often exceed Rs. 100 Cr, because of the assembly elections. This is despite multiple complaints about staff shortages in BBMP schools.

Making it worse, this budget is not fully utilised, falling way short of the allocation almost every year.

Within the header, the biggest chunk during 2022-23 was payment of honorarium to outsourced teachers. Rs. 23.5 Cr out of an allocated Rs. 25 Cr was spent for that purpose. Salary payment for staff and officers forms the largest part of the Establishment expenses at Rs. 17.9 Cr. It can be seen how BBMP is spending more money on contract teachers instead of filling existing vacancies of teachers. This is going to have a large effect on the quality of education imparted.

Notebooks, bags, uniforms form a large part of the operations and maintenance expenses. A large part of Capital Expenses includes spending earmarked for furniture and computers. While the intention is clearly there, and so is the money, only Rs. 3.1 Cr out of Rs. 8.6 Cr was spent for that purpose.

Social welfare

Social welfare includes a large number of schemes for the upliftment of underprivileged sections of the society. These include allocations for welfare of economically weaker sections, SCs/STs, women, trans-people and senior citizens.

Unlike most headers like education or horticulture a much larger amount is allocated for social welfare. In 2023-24, Rs. 513 Cr was allocated out of the Rs. 11,120 Cr budget, a significant sum, smaller than only Public Works, SWM and General administration.

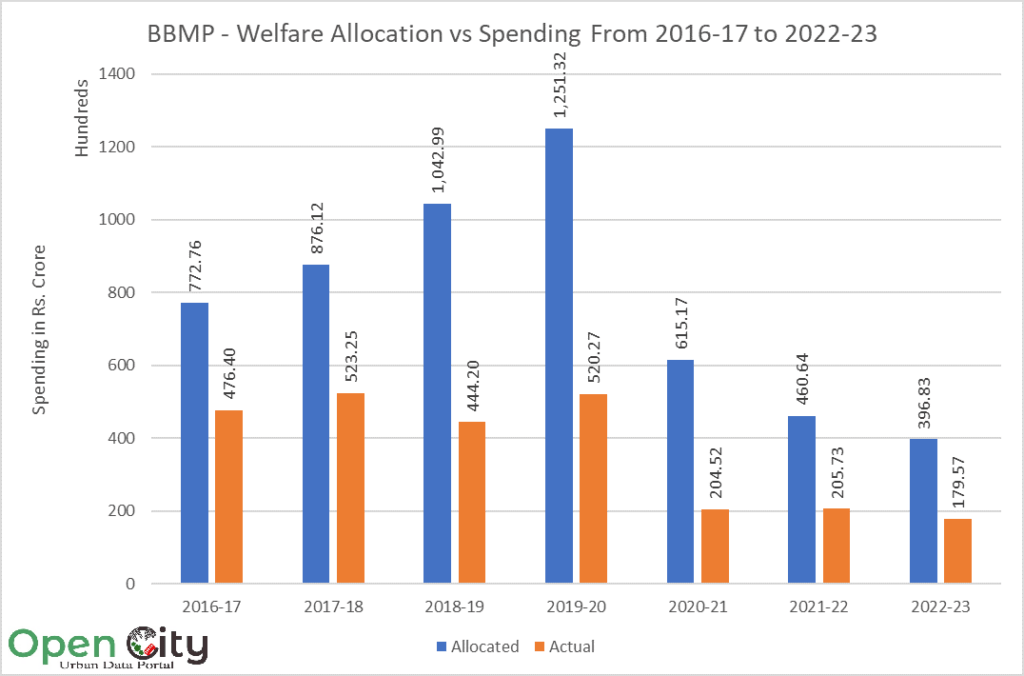

However, the actual spending tells a different story. Each year, only 40% of the amount gets spent on the various schemes.

In 2022-23, Rs. 199 crore was allocated for the welfare of SCs/STs, but only Rs. 90.7 Cr was expected to be spent. For women, Rs. 12 Crore was allocated and only Rs. 0.6 Cr estimated to be spent, just 5% of the amount.

Under the header financial assistance, Rs. 12.65 Cr is earmarked for assistance to individuals, but only Rs. 0.38 Cr was expected to be spent, less than 3%. Most of the assistance schemes remain unspent.

Total spending and the absence of the council

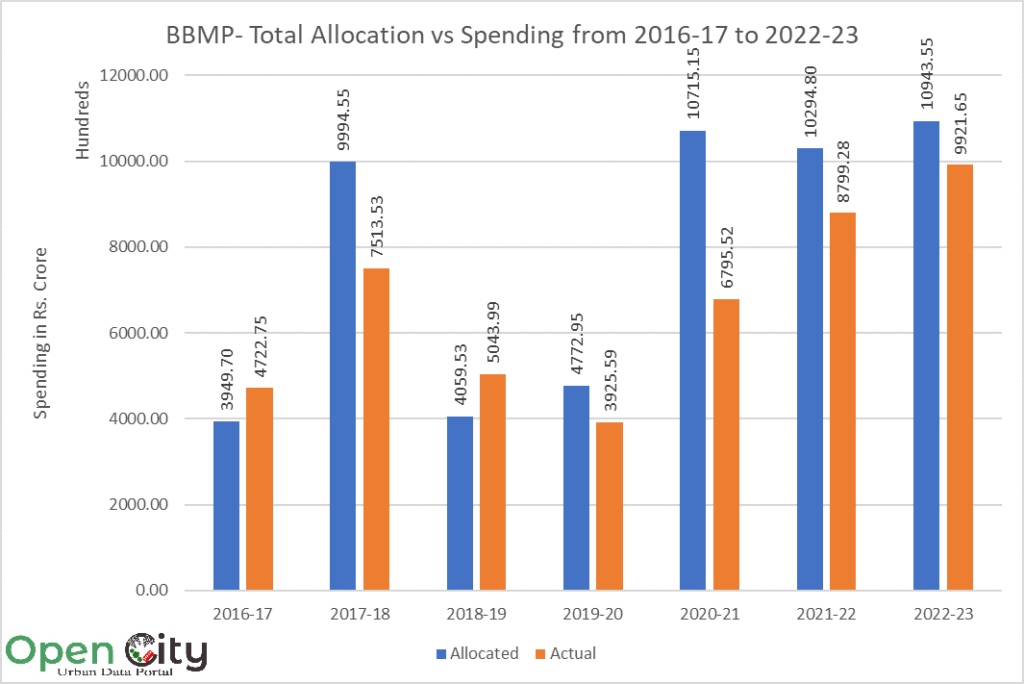

While the above analysis might seem like BBMP is not spending a lot of money, a look at the total amounts spent tells a different story.

Except during the pandemic years, the budget was either exceeded or very close to the allocation. Another trend that can be observed is that the money spent exceeded the allocation in all years till 2019-20 or was a large part of it. 2017-18 is an exception, but that being an election year a lot of money was allocated and the spending also increased massively when compared to adjacent years. The same trend is observed in 2022-23 where the highest amount was spent.

Since September 2020, BBMP has been functioning without a council and the spending from the budget reflects that. Having a council with elected corporators and mayors can ensure better spending of funds allocated from the budget. This seems especially the case with Social Welfare. While close to Rs. 500 Cr used to be spent on welfare till 2019-20, since then it has dropped to Rs. 200 Cr per year.

It has been three years since the council’s term ended. Without an elected council there is a lack of accountability on how the money is allocated and where it is spent. The recent delimitation of wards from 198 to 225 wards is expected to be an exercise leading to elections before the end of the year.

Expert view

Sukanya Bhaumik, municipal finance researcher, agrees that an elected council could lead to better spending of funds allocated from the budget for social welfare. However, she adds: “There is a sort of a policy paralysis in the absence of an elected council. But spending on social welfare also sometimes falls behind in the priorities of the local government. The government gets better optics if it spends on physical infrastructure.”

The author would like to acknowledge the efforts of Aditi Warrier in summarising the BBMP Budgets during her internship.

[This article has been republished with permission from OpenCity.in]

BBMP OUGHT TO COLLECT FINES FROM THOSE WHO TURN THIS “GARDEN CITY” INTO “GARBAGE CITY” TO MANAGE THEIR BUDGET DEFICIT

Referring to this news item that was published in Bengaluru’s own daily “DECCAN HERALD”….

Some thoughts as an introduction……

It is my dream that the glorious years of “Clean Bengaluru” of the 70s and even 80s (which were the decades of my own growing up years in this beautiful city) which used to be praised by visitors for the cleanliness maintained by the then Bangalore City Corporation – – will be restored in my lifetime!!

So, after the garbage problem became a matter of public debate, I always have this question..

* Where is the accountability for the ever-increasing charges that BBMP imposes on the hapless tax payer. Citizens forums/RWAs must get to see how BBMP is spending all the money it rakes in from the citizens.

* How have the BBMP corporators / staff put into practice the many studies / visits they undertook using the tax payers money – when the issue of SWM was raging in this city a few years ago???

* BBMP is not able to organise collection of segregated waste in all these years in spite of spending tax-payers money to find solutions – that too in a scientific and environment-friendly manner.

* Why should the citizens accept the diktat of the agency to enhance charges / collect cess????

As a tax-payer, I feel that the following must be looked into before thinking of taxing the citizen further

1. It must be noted that even if households separate dry and wet waste, the collected waste is mixed up in the vehicles doing door-to-door waste collection. This forum and RWAs must take the lead in making BBMP bring about odd-even dates collection days (or any kind of workable system) for ensuring collection of segregated dry and wet waste. It must be demanded of BBMP to put in place a proper system is in place and collect segregated waste, before they contemplate another hike in charges for a job they don’t do properly in the first place.

LET THE CITIZENS KNOW THROUGH COMMUNICATION CHANNELS LIKE NEWSPAPERS & SOCIAL MEDIA WHAT BBMP HAS DONE WITH THE WASTE THAT IT HAS COLLECTED. IT WILL SET MANY A CITIZEN THINKING… OF WAYS TO BE RESPONSIBLE AND REDUCE THE WASTE THEY GENERATE…

2. It is such an annoying sight for us who pay our house taxes to BBMP to see garbage strewn in public places.

Are street corners and flyovers being considered as “NO-MAN’S LAND” where irresponsible citizens get away with such blatant disregard for maintaining hygiene?? BBMP should take steps to collect fines from those throwing garbage on flyovers and in public places. Shouldn’t BBMP have proper system to incessantly catch and fine such wrong-doers?? We hear in certain quarters that in Govt agencies, the staff who should be in the field hardly get out of the offices. Are the officials of health dept of BBMP, checking if the work is going on as it should. If they do, such a situation of unhygienic practices of throwing garbage in public places will be checked. And BBMP staff who do their conscientiously must also be rewarded suitably with promotions, so that there is an impetus for them to even go beyond the call of duty.

In today’s world, efficiency and effectiveness is the buzz-word – and accountablility is another; in all areas of professional and public spheres of life.

The onus ought to be on BBMP to show how the solid waste management is happening NOW. The citizens have to be shown that the taxpayers’ money is being used as it should be. It has powers to also make offenders fall in line as per the law. Such powers must be invoked . A consistent effort must be made to show the offenders that people cannot get away with not adhering to public hygiene. Then people will fall in line and positive results will achieved for the collective good of all.

It is the hope of concerned citizens that a forum like this ensures that there is accountability in public agencies. Citizen Matters and RWAs are the voice of the people to question the powers-that-be on the justifiability of collecting more and more tax from the citizens.

This piece is written having the good of our Garden City in mind. BBMP and the citizens alike must work hand-in-hand for the collective good. Hope the good offices of Citizen Matters will make this work and citizens not only pay taxes but also enjoy a clean and hygienic city. Many thanks for all your efforts!